Fee Model¶

The interBTC bridge uses conceptually two different and independent fee models:

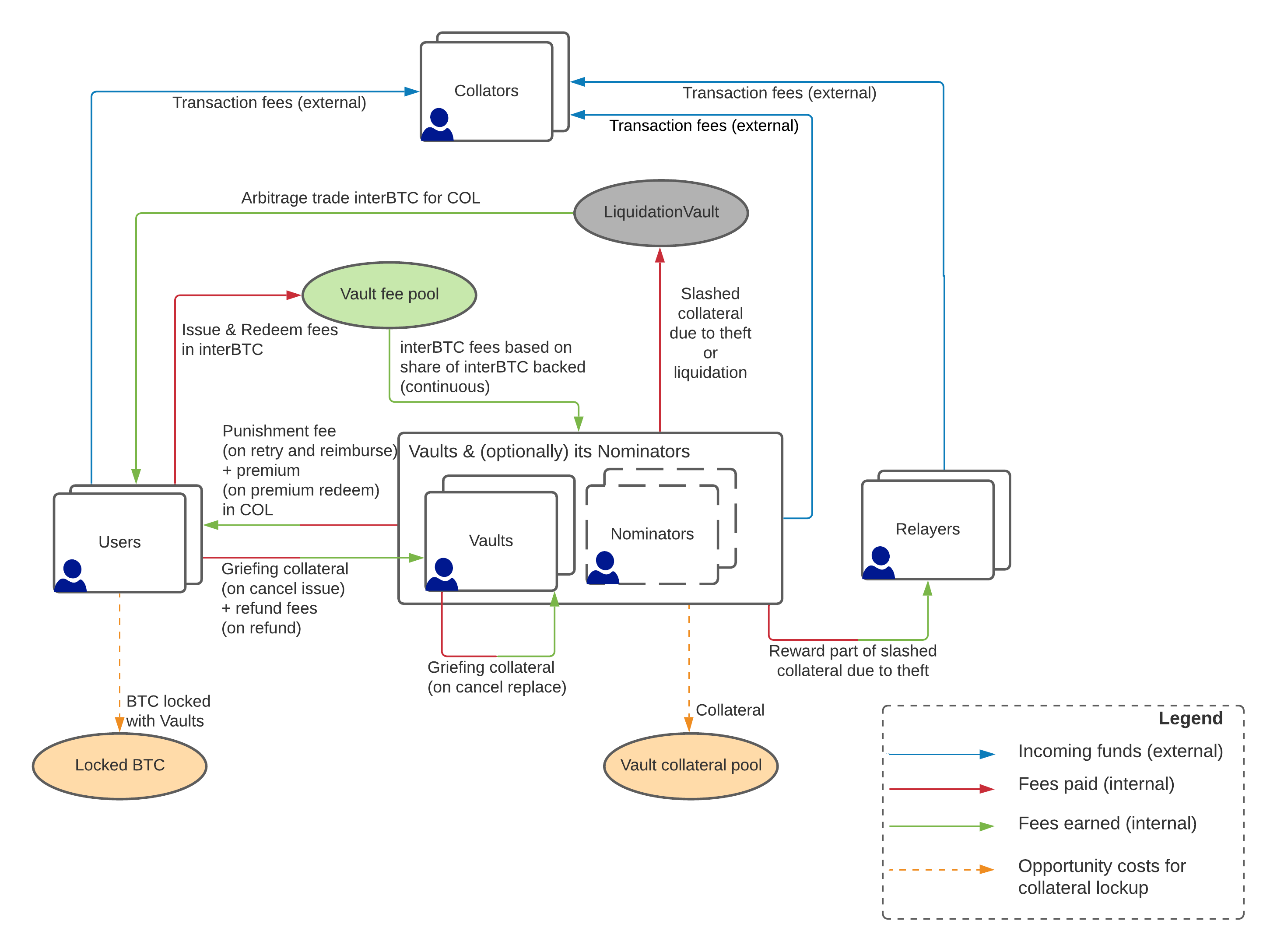

interBTC Fee Model. The internal interBTC bridge fee model covers any payments made through the operation of the bridge, e.g., the issue, redeem, or replace processes. This process concerns Users, Vaults (and its Nominators), and Relayers.

Transaction Fee Model. The transaction fees are essentially the DOT fees paid on every transaction to the Collators.

Payment Flows¶

We detail the payment flows for both models in the figure below:

Fig. 14 Detailed overview of fee accrual in the interBTC bridge, showing interBTC Fee Model and Transaction Fee Model payment flows, as well as opportunity costs.¶

interBTC Fee Model¶

Issue and Redeem Fee Distribution¶

The primary fees in interBTC are paid by users during Issue and Redeem as a relative fee on the issued or redeemed interBTC.

Vaults earn fees based on their currently backed interBTC (i.e., vault.issuedTokens). To reduce variance of payouts, the interBTC bridge implements a pooled fee model. This means that Vaults earn a share of each fee based on their share of issued interBTC in the bridge.

If the Vault does not back interBTC then it does not have a stake in the system and it will not receive any rewards, i.e., its stake is 0. Conversely, if the Vault has any issued interBTC, the Vault will earn rewards. Thus, only Vaults directly locking Bitcoin in the system will earn rewards from users.

Each time a user issues or redeems interBTC, they pay the following fees to a global fee pool:

Issue Fee: A relative fee paid based on the requested interBTC paid in interBTC, for the current parameterization see IssueFee

Redeem Fee: A relative fee paid based on the request BTC paid in interBTC, for the current parameterization see RedeemFee

Note

Since redeem fees are backed by the Vault, they must use the Replace protocol to exit the system. To solve this issue, we allow self-redeems based on the Vault’s account ID which sets the redeem fee to zero.

From this fee pool 100% is distributed among all active Vaults.

Each Vault is receiving a fair share of this fee pool by considering its stake in the system. The stake in the system is just the amount of BTC a vault is currently insuring with collateral. Calculating the rewards for a Vault is equivalent to this formula:

Eq. 1: Vault reward distribution.

Note

As an example, if we had 1 interBTC to distribute among all Vaults and our Vault having 50% of the “stake”, the individual Vault’s share could be calculated by: 100 * (1 interBTC / 200) = 0.5 interBTC

To be exact, the stake is expressed as the interBTC issued by a Vault. The issued interBTC are the interBTC currently being backed by the Vault. This shows how much a Vault’s collateral is “occupied” by users:

Eq. 2: Parameterized stake updates.

Stake Updates¶

Whenever a Vault is increasing or decreasing the number of issued interBTC (i.e., the actually locked BTC) it is backing, we MUST update their stake in the reward pool accordingly. These updates are achieved through the issue, redeem, and replace operations.

Fee Payouts¶

The Vault fee is paid each time an Issue or Redeem request is executed. Naively speaking, the bridge behaves as if on each issue and redeem, the bridge would loop through all Vaults to determine their share of stake, i.e., vault.issuedTokens / totalSupply, and distribute a percentage of the paid fees to the Vault.

Since a naive implementation would result in unbounded iteration, the fee payout is implemented in a different way. However, the outcome it is equivalent to the naive approach. The payouts are based on the pull-based Scalable Reward Distribution with Changing Stake Sizes. This scheme allows rewards to be drawn by each Vault (and Nominator) individually and at any time without the interBTC bridge having to loop over all Vaults each time rewards are paid out. Read the Excursion: Scalable Reward Distribution section if you would like to understand how the payout system works under the hood.

Griefing Fees¶

Griefing collateral is locked on requestIssue and requestReplace to prevent Griefing. If the requests are indeed cancelled, the griefing collateral is paid to the Vault that locked collateral in vain. On successful execute, the griefing collateral is refunded to the party making the request. Griefing collateral uses the currency of the transaction fees, i.e., DOT.

Issue Griefing Collateral: A relative collateral locked based on the requested interBTC paid in DOT, for the current parameterization see IssueGriefingCollateral

Replace Griefing Collateral: A relative collateral locked based on the request interBTC paid in DOT, for the current parameterization see ReplaceGriefingCollateral

Punishment Fees¶

Punishment fees are slashed from the Vault’s collateral on failed redeems. A user can choose to either retry with another Vault or reimburse the interBTC amount. In both cases, the a punishment fee is deducted from the Vault’s collateral to ensure that Vault’s are punished in both cases.

Punishment Fee: A relative fee slashed from the Vault’s collateral paid to the user in COL if a Vault failed to execute a redeem request, for the current parameterization see PunishmentFee

Theft Fee¶

Relayers receive a reward for reporting Vaults for committing theft (see reportVaultTheft and reportVaultDoublePayment).

Theft Fee: A relative fee slashed form the Vault’s collateral paid to the Relayer in COL if a Vault commits theft, for the current parameterization see TheftFee

Arbitrage¶

Arbitrage trades are executed by anyone that exchanges interBTC for COL against the LiquidationVault. The LiquidationVault is essentially an AMM with two balances:

issuedTokens: amount of interBTC that have been liquidated through safety failures, see Vault Liquidations

lockedCollateral: amount of COL that have been confiscated through safety failures, see Vault Liquidations

Anyone can now burn interBTC for COL at the exchange rate of the issuedTokens/lockedCollateral from the LiquidationVault.

As the LiquidationThreshold is strictly above the current exchange rate of the BTC/COL pair at the time of liquidation, this should represent an arbitrage opportunity: the value of burned interBTC should be lower than the value of received COL.

However, in practice, the arbitrage process might not work as intended. See External Economic Risks for a discussion of related problems. Note that there are no fees being collected to execute trades against the LiquidationVault.

Excursion: Scalable Reward Distribution¶

We recommend reading first the Scalable Reward Distribution paper and then the extension for changing rewards. Note that this scheme is “just” an efficient equivalent of the Vault distribution outlined above. Last, we extend this scheme to account for Vault Nomination and Vault Liquidations. The adopted scheme is described in the README of the implementation.

Notable changes to the Scalable Reward Distribution with Changing Rewards are:

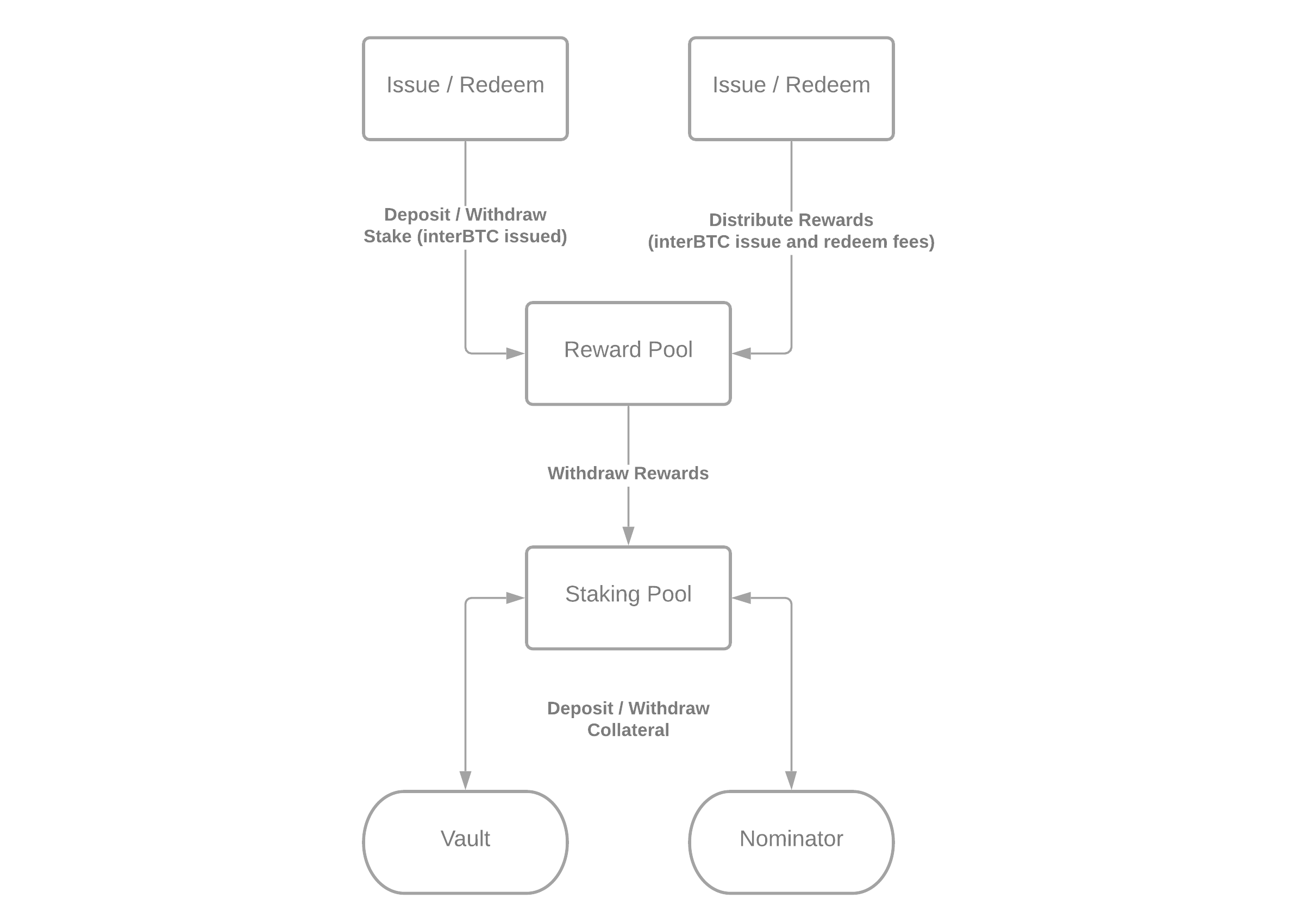

Staking Pools Fees are forwarded to a Reward Pool and then distributed to a Staking Pool. There is one Staking Pool for each Vault and all of its Nominators.

Slashing On liquidation of Vaults, no more fees are forwarded to the Staking Pool of that Vault.

See the figure below for an indication how the Staking Pools are used.

Fig. 15 Distribution of fees according to Staking Pools. Each Vault and all its Nominators are represented by a Staking Pool. This allows to distribute the applicable fees based on the global share of issued interBTC based on the stake of the Staking Pool as well as an individual distribution of fees between the Vault and its Nominators based on their share in the pool.¶

In the scalable reward distribution, a single source of truth is used to calculate rewards: the “stake”. The “stake” can be any numeric representation. In interBTC, stake is defined as: the current amount of issued interBTC. A Vault’s stake is adjusted based on the change in issued interBTC - for instance we increase the issued interBTC on successful issues and decrease this on executed redeems.

Note

For example, if a Vault executes issue requests amounting to 2,456,000 interSatoshi (smallest denomination) being added to the system, its stake would increase by 2,456,000. If the Vault then executes redeem requests, its rewards are reduced. So if the Vault redeems all 2,456,000 interSatoshi, its stake is 0 again. On a liquidation, this is again set to zero since the Vault no longer backs these tokens.

Now, each Vault’s rewards are calculated according to the following formula (equivalent to Eq. 1):

Eq. 3: Vault reward distribution using the SRD.

Definitions

stake: the amount of interBTC issued by this Vault.

reward_tally: the Vault’s accumulated rewards (can be negative or positive).

stake_delta: the stake impact based on issuing or redeeming interBTC.

total_stake: the total amount of interBTC issued by all Vaults.

reward_per_token: the current reward per current stake (the total_stake).

reward: the rewards paid from issue and redeem requests.

The reward is influenced by the total of all stakes. So the share of rewards paid to a Vault is determined by how many other Vaults are in the system and their individual stake.

Example Without Nomination

Current stake

Note: stake is always non-zero.

Vault Alice has a stake of 250

Vault Bob has a stake of 30

Vault Charlie has a stake of 100

The total stake is therefore 380.

Reward claims

Let’s assume there is a total of 1 interBTC in the reward pool based on the accumulated issue and redeem request. Then the reward_per_token = 1 interBTC / 380.

Vault Alice has a claim of

250 * 1 interBTC/380 = 0.6578947368421052 interBTCVault Bob has a claim of

30 * 1 interBTC/380 = 0.07894736842105263 interBTCVault Charlie has a claim of

100 * 1 interBTC/380 = 0.2631578947368421 interBTC

Example With Nomination

Current stake

Note: stake is always non-zero.

Vault Alice and her Nominators have a stake of 250. Alice is fully nominated such that Alice is backing 200 and her Nominators are backing 50.

Vault Bob has a stake of 30

Vault Charlie has a stake of 100

The total stake is therefore 380.

Reward claims

Let’s assume there is a total of 1 interBTC in the reward pool based on the accumulated issue and redeem request. Then the reward_per_token = 1 interBTC / 380.

Vault Alice has a claim of

200 * 1 interBTC/380 = 0.526315789 interBTCAlice’s Nominators have a claim of

50 * 1 interBTC/380 = 0.131578947 interBTCVault Bob has a claim of

30 * 1 interBTC/380 = 0.07894736842105263 interBTCVault Charlie has a claim of

100 * 1 interBTC/380 = 0.2631578947368421 interBTC

Transaction Fee Model¶

The interBTC bridge chain adopts the Polkadot relay chain model with DOT as the native currency for paying transaction fees. In this model, collators receive 100% of the transaction fees paid by Users, Vaults, and Relayers. We refer to the official Polkadot documentation for full details.